More Clients,

Less Complexity

Focus on growth, not investment administration. Our managed account solutions give you time to nurture your clients and grow your business.

If you run an advice business, your constraint isn’t ideas — it’s hours. Compliance, admin, model updates and client communications all compete for time. That’s why managed accounts have moved from “interesting” to essential infrastructure for many Australian practices: they reduce the operational load so advisers can spend more time focusing on their clients and on growth.

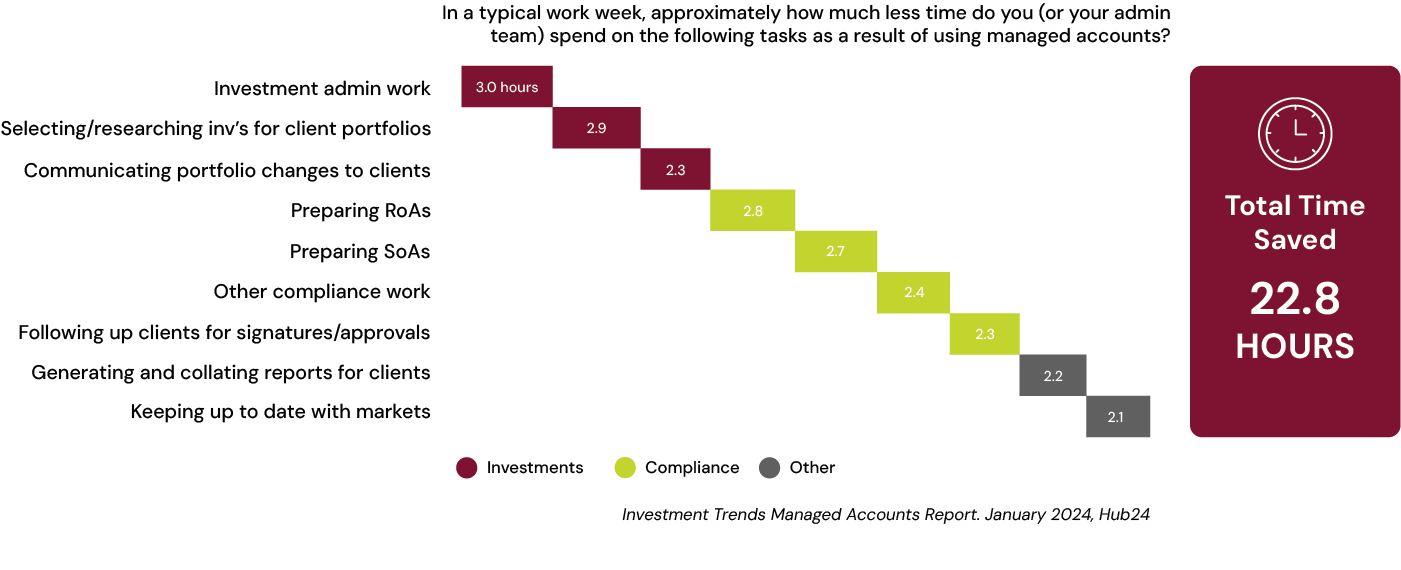

Independent research backs this up. The latest State Street Global Advisors / Investment Trends report finds advisers who use managed accounts save 23.9 hours per week on average — almost three business days. That’s up from 22.8 hours in 2024 and around 15 hours in 2022, underscoring that efficiency gains are real and increasing.

One-to-many implementation: Model changes and rebalances flow across all relevant client accounts simultaneously, replacing case-by-case file work. This strips out ticketing, data entry, and much of the back-and-forth that slows review meetings.

Cleaner governance and visibility: For dealer groups, centralised models create a consistent operating rhythm for investment committees and supervision. With platform-level reporting, licensees can see exposures and drift at scale, rather than reconstructing them practice by practice. The cumulative effect is fewer key-person bottlenecks and faster, cleaner execution when markets move.

Less duplication, more cadence: Portfolio maintenance shifts to an investment manager or asset consultant under a documented process. Advice teams shift from reactive trading to scheduled reviews, advice documentation, and proactive client contact — the work that actually grows the business. Across multiple studies, principals report back-office reductions of ~15–16 hours per week and broad time savings for 60–90% of users.

Time savings only matter if they convert to better client outcomes and business performance. Evidence suggests they do:

Clients want transparency and control. With managed accounts, particularly those structured as SMAs, investors beneficially own the underlying securities rather than a pooled fund unit, and many platforms allow sensible preferences (e.g., exclude a holding, or substitute one large-cap for another) without breaking the model. That’s tangible, explainable value that builds trust.

The product mix reflects this shift. According to the 2025 SSGA/Investment Trends snapshot, multi-asset class models account for 68% of the models recommended in the past year, and roughly a third of advisers use managed accounts for core allocation — not just a sleeve. Strategy-wise, growth remains the most commonly used risk profile.

For licensees and larger groups, managed accounts deliver:

The commercial upshot: more consistent client outcomes, fewer one-off exceptions, and less operational drag on advisers.

Fees and transparency: The value case must be crystal clear. Industry commentary notes that fee structures can be complex (platform administration, SMA/RE fees, and underlying MERs), and clients can be confused about “what they actually pay.” That’s changing — the SMA Reporting Standard (SMARS) aims to standardise SMA fee fields across providers, improving comparability. Until this is ubiquitous, be explicit about total cost and demonstrate what clients receive for it.

Regulatory context: ASIC’s RG 179 sets expectations for MDA services (roles, oversight, conflicts). Recent industry reporting also highlights that MDAs remain on the regulator’s radar, so treat governance as a feature, not a footnote: document who makes investment decisions, how changes are communicated, and how suitability is reviewed.

Selecting the right structure: SMA, MDA or managed portfolio? Balance control, licensing obligations and desired flexibility. For many advice businesses, managed accounts deliver the cleanest path to visibility and beneficial ownership; where a higher degree of discretion is required, MDAs may fit — with the corresponding governance responsibilities.

Managed accounts don’t just trim admin; they rebalance where your time goes — from paperwork and ad-hoc trading to client strategy and business growth. The evidence base is consistent across years and sources: double-digit hours saved weekly, improved supervision for licensees, and a client experience built on transparency and control. If capacity is your constraint, this is a lever that reliably gives it back. Pilot it with a clear governance framework, measure the time you free up, and redeploy that capacity into advice.

Focus on growth, not investment administration. Our managed account solutions give you time to nurture your clients and grow your business.

Dynamic portfolio management, high-quality investments, risk management and diversified portfolio management.

Tailored portfolios, responsiveness, and proactive communications are core to our philosophy.

Clients retain direct ownership of investments. Complete transparency and dependable communication.

Consistent performance and an experienced investment team with over 260 years of combined experience.